Understanding Impermanent Loss in Crypto Farming

Impermanent loss is a critical concept to grasp if you’re venturing into the world of crypto farming and decentralized finance (DeFi). It refers to the temporary loss of value experienced by liquidity providers (LPs) in decentralized exchanges (DEXs) when the price of their deposited assets diverges from the initial ratio at the time of deposit. While you earn fees for providing liquidity, these gains can sometimes be offset by impermanent loss, especially in volatile markets. This article dives deep into what impermanent loss is, how it happens, and how to potentially mitigate its effects.

What Causes Impermanent Loss?

Decentralized exchanges like Uniswap and PancakeSwap rely on automated market makers (AMMs). These AMMs use liquidity pools, which are essentially smart contracts containing two or more tokens. Liquidity providers deposit tokens into these pools, maintaining a specific ratio (e.g., 50/50). The AMM uses a formula (typically x*y=k, where x and y are the amounts of each token and k is a constant) to determine the price of the tokens.

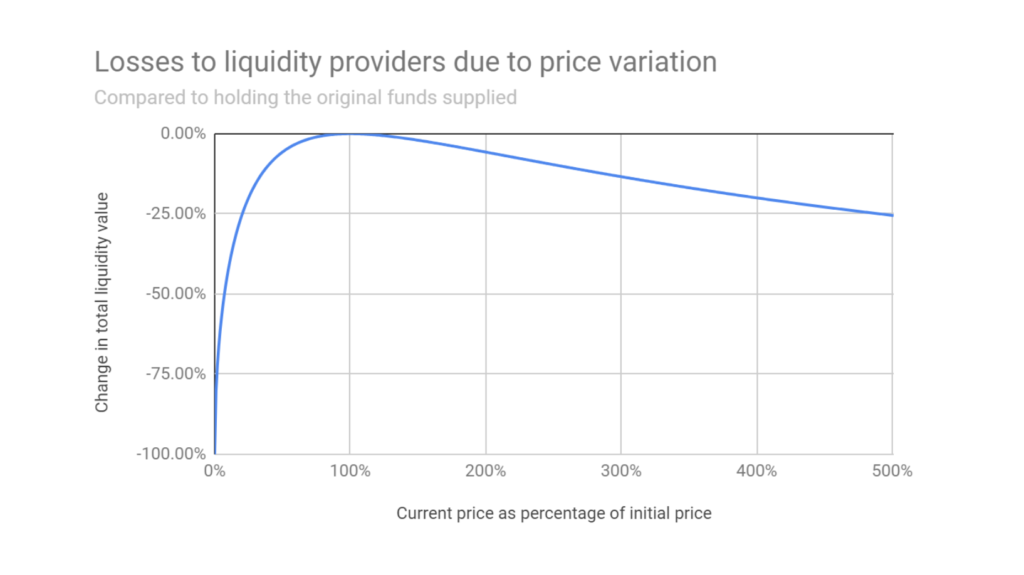

Impermanent loss occurs when the price ratio of the deposited tokens changes significantly after you’ve deposited them. The AMM algorithm rebalances the pool to reflect the new price ratio. This rebalancing is what creates the “loss.” It’s considered “impermanent” because the loss is only realized if you withdraw your liquidity while the price ratio is different from when you deposited. If the price ratio reverts to the original state, the loss disappears.

How Impermanent Loss Works: An Example

Imagine you deposit $100 worth of ETH and $100 worth of DAI (stablecoin) into a liquidity pool. At the time of deposit, 1 ETH = 100 DAI. The total pool value is $200, and you own 5% of the pool.

Later, the price of ETH doubles to 1 ETH = 200 DAI. The AMM rebalances the pool. Arbitrageurs will add DAI and remove ETH until the ratio reflects the current market price. Let’s say the pool now contains approximately 0.707 ETH and 141.42 DAI. The total pool value is now $282.84.

If you withdraw your 5% share, you’ll receive 0.035 ETH and 7.07 DAI. At the current price, this is worth (0.035 * 200) + 7.07 = $14.14. Therefore your share is worth $14.14.

Let’s compare this to what you would have if you simply held the assets. If you held your initial 1 ETH and 100 DAI, your holdings would now be worth (0.05 * 200) + (0.05 * 100) = $15. Therefore, you have incurred impermanent loss. You have less money providing liquidity than holding the assets.

This is a simplified example. Transaction fees and the complexity of the AMM algorithm impact the actual impermanent loss.

graph LR

A[You Deposit ETH & DAI] --> B(Initial Ratio: 1 ETH = 100 DAI);

B --> C{Price of ETH Doubles};

C --> D[AMM Rebalances Pool];

D --> E(Arbitrageurs Add/Remove Tokens);

E --> F{New Ratio: 1 ETH = 200 DAI};

F --> G[You Withdraw Your Share];

G --> H{Value of Withdrawn Assets < Value of Simply Holding};

H --> I(Impermanent Loss);

Factors Affecting Impermanent Loss

- Volatility: Higher volatility between the tokens in a pool leads to greater impermanent loss. Stablecoin pairs experience less impermanent loss than volatile pairs like ETH/BTC.

- Pool Composition: Pools with assets correlated in price (e.g., two different stablecoins) tend to experience less impermanent loss.

- Trading Volume: High trading volume can generate more fees, potentially offsetting the impermanent loss.

Mitigating Impermanent Loss

While it’s impossible to completely eliminate impermanent loss, here are some strategies to mitigate its impact:

- Choose Stablecoin Pairs: Providing liquidity to pools with stablecoins or pegged assets minimizes price divergence and reduces impermanent loss.

- Choose Correlated Assets: Assets that generally move in the same direction experience less volatility relative to each other.

- Select Pools with High Trading Volume: Increased trading volume results in higher fees earned, which can offset potential impermanent loss.

- Consider Insurance: Some platforms offer insurance products that cover impermanent loss, although these often come with a cost.

- DYOR: Thoroughly research the project, the tokens involved, and the specific liquidity pool before depositing funds. Understand the risks associated with each pool.

Key Takeaways

- Impermanent loss occurs when the price ratio of deposited tokens in a liquidity pool changes.

- Volatility is the primary driver of impermanent loss.

- Impermanent loss is “impermanent” because it’s only realized if you withdraw your liquidity while the price ratio is different.

- Fees earned from providing liquidity can potentially offset impermanent loss.

- Strategies like choosing stablecoin pairs and high-volume pools can help mitigate impermanent loss.

Understanding the Risks

Crypto farming and providing liquidity are not without risks. Beside impermanent loss, you may also face smart contract risks, hacks or exploits, and general market risks.