ETFs vs. Halving: What REALLY Fuels the 2025 Crypto Bull Run?

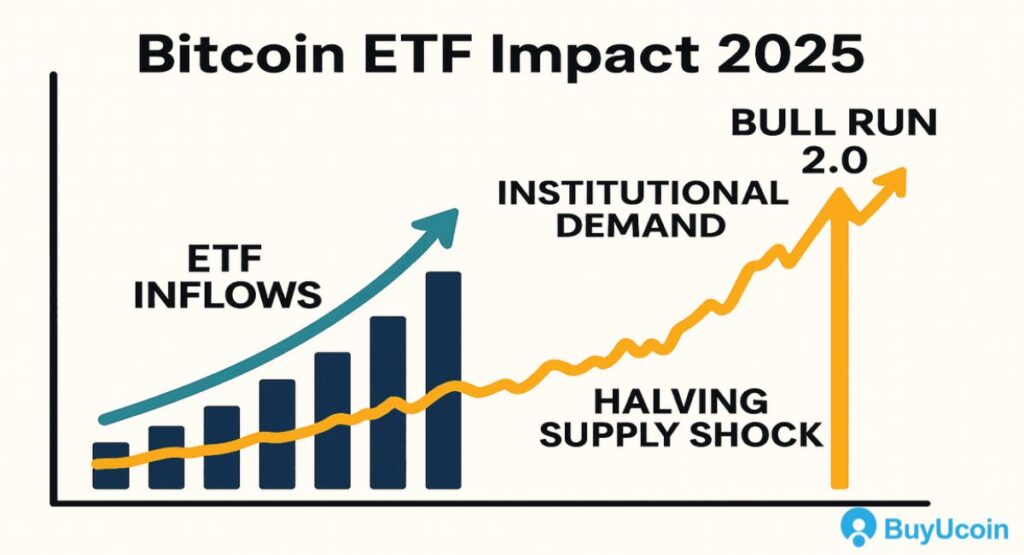

The cryptocurrency market is buzzing with anticipation for 2025. Two primary drivers are being touted as the key to the next bull run: the increased accessibility driven by Exchange-Traded Funds (ETFs) and the recurring halving event embedded in Bitcoin’s code. Which of these forces will exert more influence, and how will they interact to shape the market? Let’s dive in.

The ETF Effect: Institutional Money Floodgates Open?

The introduction of spot Bitcoin ETFs has been heralded as a watershed moment for the crypto industry. These financial products allow institutional investors and retail traders to gain exposure to Bitcoin without directly holding the underlying asset.

How Spot ETFs are Changing the Game

Spot ETFs simplify Bitcoin investment for a broader audience. They:

- Reduce complexity: Investors don’t need to manage private keys or navigate crypto exchanges.

- Increase accessibility: ETFs are traded on traditional stock exchanges, making them available through brokerage accounts.

- Boost liquidity: ETFs enhance market liquidity, potentially reducing price volatility over time.

- Offer regulatory comfort: ETFs are regulated financial products, providing a degree of security and legitimacy.

Analyzing ETF Inflows and Price Correlation

Initial data suggests a strong correlation between ETF inflows and Bitcoin’s price. Significant inflows often coincide with upward price movements.

import pandas as pd

import numpy as np

# Sample Data (Replace with actual ETF inflow and BTC price data)

data = {'Date': pd.to_datetime(['2024-01-01', '2024-02-01', '2024-03-01', '2024-04-01', '2024-05-01']),

'ETF_Inflow': [100, 150, 200, 50, 250], # In millions

'BTC_Price': [40000, 45000, 50000, 48000, 55000]} # In USD

df = pd.DataFrame(data)

# Calculate Correlation

correlation = df['ETF_Inflow'].corr(df['BTC_Price'])

print(f"Correlation between ETF Inflow and BTC Price: {correlation}")

#Basic Linear Regression

from sklearn.linear_model import LinearRegression

model = LinearRegression()

model.fit(df[['ETF_Inflow']], df[['BTC_Price']])

print(f"Linear Regression Score: {model.score(df[['ETF_Inflow']], df[['BTC_Price']])}")

This Python snippet demonstrates how to calculate the correlation between ETF inflows and Bitcoin prices using historical data. A high positive correlation suggests that increased ETF demand contributes significantly to price appreciation. Linear Regression is also performed to show how well the inflow might predict the price change.

Potential Drawbacks: Centralization and Regulatory Scrutiny

While ETFs offer numerous benefits, potential drawbacks exist:

- Centralization: A few large institutions holding significant amounts of Bitcoin through ETFs could lead to centralization concerns.

- Regulatory risk: Changes in regulatory frameworks could impact ETF operations and investor confidence.

- Market manipulation: While regulated, ETFs aren’t immune to market manipulation, potentially impacting Bitcoin’s price.

The Halving’s Historical Impact: Supply Shock or Overhyped Event?

The Bitcoin halving is a pre-programmed event that occurs approximately every four years, reducing the block reward miners receive for validating transactions by 50%. Historically, halvings have been associated with significant price increases.

Past Halving Cycles: Lessons Learned

Analyzing past halving cycles reveals a pattern:

- 2012 Halving: Bitcoin price experienced a substantial increase in the year following the halving.

- 2016 Halving: Similar to 2012, the price rallied significantly post-halving.

- 2020 Halving: While the initial impact was less dramatic, Bitcoin eventually reached new all-time highs.

Quantifying the Supply Reduction Impact

The halving directly reduces the supply of new Bitcoin entering the market. This supply reduction, coupled with sustained or increased demand, can create a supply shock that drives up prices. The supply shock is less and less impactful each cycle, but is still worth consideration.

Diminishing Returns? Why This Halving Might Be Different

While past halvings have been bullish catalysts, the upcoming halving might have a different impact due to:

- Increased Market Maturity: The Bitcoin market is more mature and liquid than in previous cycles.

- ETF Influence: The presence of ETFs could dilute the impact of the halving by providing alternative avenues for Bitcoin exposure.

- Macroeconomic Conditions: Global economic factors, such as inflation and interest rates, can influence investor sentiment and risk appetite.

ETF Fueled Demand vs. Halving Supply Crunch: A Comparative Analysis

To understand the potential impact of the 2025 bull run, we need to compare the forces of ETF-driven demand with the halving-induced supply crunch.

Supply/Demand Dynamics: A Detailed Breakdown

- ETFs: Increase demand by providing easy access for institutional and retail investors.

- Halving: Reduces supply by decreasing the block reward for miners.

The interplay between these forces will determine the price trajectory. If ETF demand significantly outweighs the supply reduction, we can expect substantial price appreciation.

Market Sentiment and Investor Psychology

Market sentiment plays a crucial role. Fear of missing out (FOMO) can amplify price movements, while negative news or regulatory actions can trigger sell-offs.

The Role of Macroeconomic Factors

Macroeconomic factors, such as inflation, interest rates, and geopolitical events, can significantly impact the crypto market. A favorable macroeconomic environment can boost investor confidence and fuel further investment in Bitcoin.

Predicting the 2025 Bull Run: A Balanced Perspective

Predicting the future is impossible, but we can analyze the available data and identify key indicators to watch.

Combining ETF and Halving Analysis for Price Prediction

A comprehensive approach involves:

- Monitoring ETF inflows and outflows.

- Analyzing the impact of the halving on Bitcoin’s supply dynamics.

- Assessing market sentiment and investor psychology.

- Evaluating the influence of macroeconomic factors.

Identifying Key Indicators to Watch

- ETF Inflow Volume: A sustained increase in ETF inflows indicates strong demand.

- Bitcoin Hash Rate: A rising hash rate suggests increased mining activity and network security.

- On-Chain Metrics: Analyzing on-chain data, such as transaction volume and wallet activity, can provide insights into market behavior.

- Google Trends: Interest in search terms like “Bitcoin” and “crypto” are good indicators of retail interest.

Long-Term vs. Short-Term Outlook

While the long-term outlook for Bitcoin remains positive, short-term volatility is inevitable. Investors should be prepared for price fluctuations and adopt a long-term investment strategy.

If you are thinking about building your own crypto news website, or a portfolio tracking tool, you’ll need a reliable hosting provider. I’ve found Hostinger to be an excellent option. Their hosting is incredibly fast and surprisingly affordable, plus their user interface makes it super easy to manage your projects.

Conclusion: Navigating the 2025 Crypto Landscape: A Strategic Approach

The 2025 crypto bull run will likely be driven by a combination of factors, with ETFs and the halving playing significant roles. Understanding the interplay between these forces, along with market sentiment and macroeconomic conditions, is crucial for navigating the crypto landscape and making informed investment decisions. Stay informed, diversify your portfolio, and manage your risk effectively.

Disclaimer: This is not financial advice.

Visual Guide

A[2025 Crypto Bull Run?] –> B{Key Drivers};

B –> C[ETFs (Exchange-Traded Funds)];

B –> D[Halving Event];

C –> E[Increased Accessibility];

E –> F[Institutional Money];

E –> G[Retail Traders];

D –> H[Reduced Bitcoin Supply];

H –> I[Increased Scarcity];

C –> J[Spot ETFs];

J –> K[Reduce Complexity];

J –> L[Increase Accessibility];

J –> M[Boost Liquidity];

J –> N[Offer Regulatory Comfort];

O[ETF Inflows] –> P[Price Correlation];

P — Strong Correlation –> Q[Upward Price Movements];