# Token Sales: From ICOs to IDOs - Mastering the Regulatory Maze & Avoiding Pitfalls

The world of cryptocurrency funding has evolved rapidly, leaving a trail of successes and failures. Understanding the trajectory of token sales, from the frenzy of Initial Coin Offerings (ICOs) to the rise of Initial DEX Offerings (IDOs) and beyond, is crucial for anyone venturing into this space. Equally important is navigating the increasingly complex regulatory landscape to avoid severe legal and financial repercussions.

## Introduction: The Wild West of Crypto Funding and Why Regulation Matters

The early days of crypto funding resembled a digital Wild West. ICOs, promising revolutionary projects, attracted billions of dollars with minimal oversight. This lack of regulation, while initially exciting, also led to rampant scams, rug pulls, and unsustainable projects. The need for a more structured and regulated environment became painfully apparent. Regulation, while sometimes perceived as stifling innovation, is essential for building trust, protecting investors, and ensuring the long-term viability of the crypto ecosystem. Ignoring regulatory requirements is akin to playing Russian roulette with your project's future.

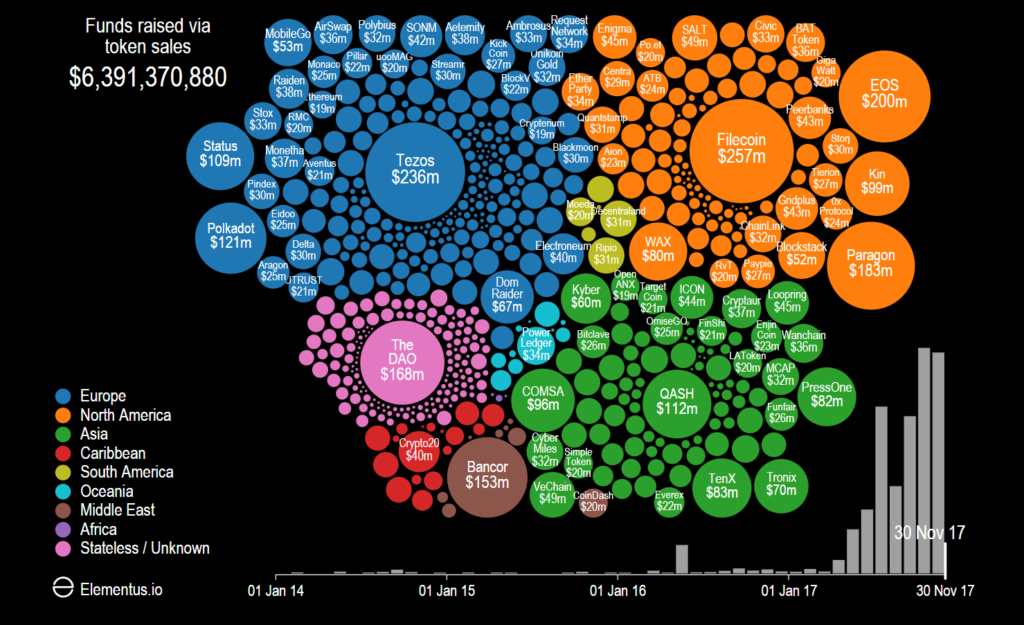

## ICOs: The Boom, the Bust, and the Lessons Learned (2017-2018)

The 2017-2018 ICO boom saw a massive influx of capital into blockchain projects. The promise of democratized fundraising and disruptive innovation fueled the frenzy. Projects often released a whitepaper, created a website (often on [Hostinger](https://hostinger.com?REFERRALCODE=JEUSANTA8TBE) due to its affordability and ease of use), and launched a token sale to the public.

However, the ICO bubble burst spectacularly. Several key factors contributed to the downfall:

* **Lack of Due Diligence:** Investors often poured money into projects with little understanding of their technology, team, or business model.

* **Scams and Exit Scams:** Many ICOs were outright scams designed to steal investors' funds.

* **Unrealistic Promises:** Overhyped projects promised unrealistic returns and failed to deliver on their promises.

* **Regulatory Crackdowns:** As the SEC and other regulatory bodies began to scrutinize ICOs, many projects faced legal action.

The lessons learned from the ICO era are invaluable. They highlighted the importance of:

* **Thorough Research:** Investors must conduct due diligence before investing in any token sale.

* **Transparency:** Projects should be transparent about their team, technology, and business model.

* **Compliance:** Adhering to regulatory requirements is paramount.

## IDOs: A New Dawn? Exploring Decentralized Exchanges and Enhanced Security

Initial DEX Offerings (IDOs) emerged as a response to the shortcomings of ICOs. IDOs leverage decentralized exchanges (DEXs) to launch tokens, offering several potential advantages:

* **Accessibility:** IDOs provide broader access to token sales, as anyone with a crypto wallet can participate.

* **Liquidity:** Tokens are typically listed on the DEX immediately after the IDO, providing instant liquidity.

* **Decentralization:** IDOs are often more decentralized than ICOs, reducing the risk of centralized control and manipulation.

* **Lower Barriers to Entry:** Compared to IEOs (Initial Exchange Offerings, discussed later), the barriers to entry for projects are generally lower.

However, IDOs also have their risks:

* **Rug Pulls:** While DEXs can improve transparency, rug pulls (where a project team abandons the project and steals the funds) are still a risk.

* **Front-Running:** Bots can exploit price fluctuations and purchase tokens ahead of other investors.

* **Volatility:** DEXs can be highly volatile, leading to significant price swings.

Here's a simple Python example of how you might interact with a DEX using a library like `web3.py` (note: this is a simplified example and requires configuration):

```python

from web3 import Web3

# Replace with your DEX endpoint

w3 = Web3(Web3.HTTPProvider('YOUR_DEX_ENDPOINT'))

# Replace with the token contract address and your wallet address

token_contract_address = '0x...'

wallet_address = '0x...'

# Get the token contract

# (You would need the ABI of the token contract here)

# token_contract = w3.eth.contract(address=token_contract_address, abi=...)

# Example: Check token balance (requires the contract object to be properly instantiated)

# balance = token_contract.functions.balanceOf(wallet_address).call()

# print(f"Token balance: {balance}")

Beyond ICOs and IDOs: Emerging Token Sale Models (STOs, IEOs, etc.)

The token sale landscape continues to evolve, with new models emerging to address specific needs and challenges:

- Security Token Offerings (STOs): STOs offer tokens that represent ownership in an asset, such as equity or real estate. STOs are typically subject to stricter regulatory requirements than ICOs or IDOs, as they are considered securities.

- Initial Exchange Offerings (IEOs): IEOs are conducted on centralized cryptocurrency exchanges. Exchanges vet projects before listing them, providing a degree of due diligence for investors. However, IEOs often require projects to pay high listing fees.

- Simple Agreement for Future Tokens (SAFTs): SAFTs are investment contracts that allow accredited investors to invest in a project before the token is launched. SAFTs aim to comply with securities laws by selling the right to future tokens, not the tokens themselves.

Navigating the Regulatory Minefield: Key Considerations for Token Sales Globally

Regulatory landscapes vary significantly across jurisdictions. Understanding the specific regulations in the target market is crucial. Key considerations include:

- Securities Laws: Determine whether the token is considered a security. If so, compliance with securities laws is mandatory. The Howey Test is often used to determine if an asset is a security in the US.

- KYC/AML Compliance: Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are essential for verifying the identity of investors and preventing illicit activity.

- Data Protection Laws: Compliance with data protection laws, such as GDPR, is necessary when collecting and processing investor data.

- Tax Implications: Understand the tax implications of token sales for both the project and investors.

- Legal Counsel: Engage experienced legal counsel to ensure compliance with all applicable regulations.

Failing to comply with regulations can result in:

- Fines and Penalties: Regulatory bodies can impose significant fines for non-compliance.

- Cease and Desist Orders: Regulators can issue orders to stop token sales.

- Criminal Charges: In some cases, individuals involved in non-compliant token sales may face criminal charges.

Conclusion: Building Trust and Compliance for Sustainable Token Offerings

The future of token sales lies in building trust and ensuring compliance. Projects that prioritize transparency, regulatory adherence, and investor protection are more likely to succeed in the long run.

Remember that a fast and reliable website is key to any successful token sale, and for an affordable and easy-to-use solution, many projects turn to Hostinger.

Disclaimer: This is not financial advice.

“`

Visual Guide

A[Token Sales] –> B(ICOs: Initial Coin Offerings);

A –> C(IDOs: Initial DEX Offerings);

A –> D{Regulation: The Regulatory Maze};

B –> E{Boom (2017-2018)};

B –> F{Bust};

E –> G[Massive Capital Influx];

E –> H[Democratized Fundraising Promise];

F –> I[Lack of Due Diligence];

F –> J[Scams and Exit Scams];

D –> K[Building Trust];

D –> L[Protecting Investors];

D –> M[Long-Term Viability];

D –> N[Avoiding Legal/Financial Repercussions];