Unlocking Trillions: Real World Asset (RWA) Tokenization with Data Centers & LiquidChain

Introduction: The Untapped Potential of RWA Tokenization

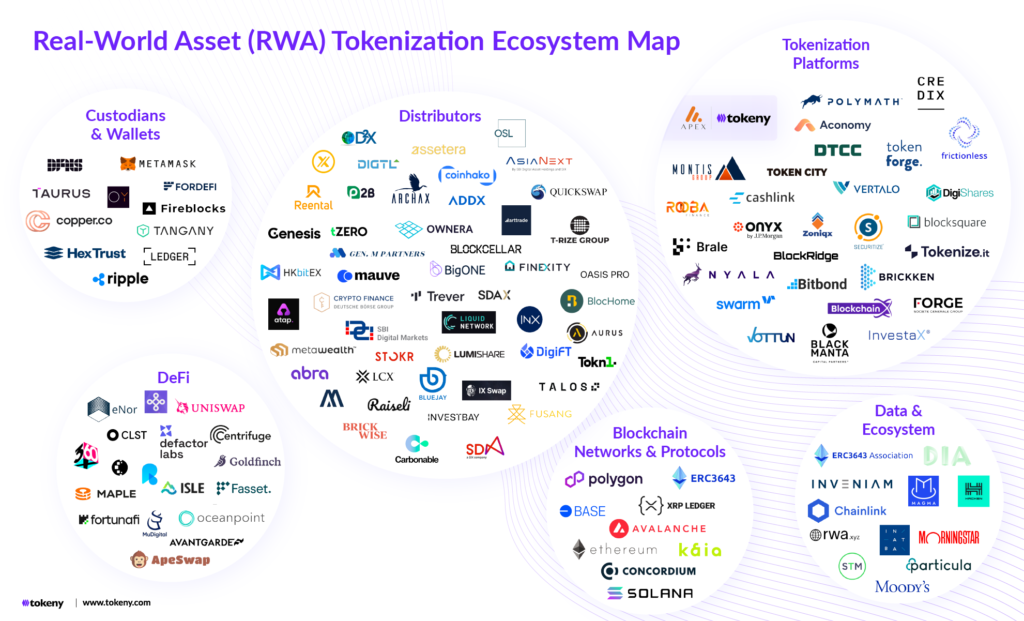

Real World Asset (RWA) tokenization is rapidly emerging as a transformative force in finance, promising to unlock trillions of dollars in previously illiquid assets and revolutionize investment opportunities. By representing tangible assets like real estate, commodities, and even infrastructure like data centers as digital tokens on a blockchain, RWA tokenization opens up new avenues for accessibility, efficiency, and transparency.

What is RWA Tokenization and Why is it Disrupting Finance?

RWA tokenization is the process of representing ownership rights to a physical or real-world asset on a blockchain. These digital representations, called tokens, can be bought, sold, and traded like any other cryptocurrency, but their value is pegged to the underlying asset. This process is disrupting finance in several key ways:

- Increased Liquidity: Traditionally illiquid assets, such as real estate or artwork, can be divided into smaller, more affordable fractions represented by tokens, making them easier to buy and sell.

- Democratized Access: Tokenization lowers the barrier to entry for investors, allowing individuals to participate in markets that were previously only accessible to institutional investors.

- Enhanced Transparency: Blockchain technology provides a transparent and immutable record of ownership, reducing fraud and increasing trust.

- Improved Efficiency: Tokenization streamlines the processes associated with asset ownership, such as transfer, settlement, and compliance, reducing costs and delays.

- Greater Programmability: Tokens can be programmed with smart contracts, automating dividend payments, voting rights, and other governance functions.

Data Centers as Tokenized Assets: Powering the Future of Digital Infrastructure

Data centers, the backbone of the digital economy, are prime candidates for RWA tokenization. These facilities, which house the servers and infrastructure that power the internet, are capital-intensive assets with significant operational costs. Tokenizing data centers offers several benefits:

- Raising Capital: Tokenization allows data center operators to raise capital more efficiently by selling tokens representing fractional ownership of the facility.

- Attracting Investors: By offering tokens, data center operators can attract a broader range of investors, including retail investors who may not have had access to traditional investment opportunities.

- Improving Liquidity: Tokenized data centers can be traded on secondary markets, providing investors with liquidity and allowing them to exit their investment more easily.

Let’s illustrate how a simple Python script could be used (though greatly simplified for example purposes only) to simulate token creation representing a data center:

class DataCenterToken:

def __init__(self, symbol, name, total_supply, data_center_name):

self.symbol = symbol

self.name = name

self.total_supply = total_supply

self.data_center_name = data_center_name

self.owner = "DataCenterCompanyXYZ" # Example owner

def display_token_info(self):

print(f"Token Symbol: {self.symbol}")

print(f"Token Name: {self.name}")

print(f"Total Supply: {self.total_supply}")

print(f"Data Center: {self.data_center_name}")

print(f"Owner: {self.owner}")

# Example instantiation

data_center_token = DataCenterToken(

symbol="DCTXYZ",

name="XYZ Data Center Token",

total_supply=1000000,

data_center_name="XYZ Global Data Hub"

)

data_center_token.display_token_info()

This is a very basic illustration, but it shows the conceptual representation of a data center being tied to a token. Real-world implementation involves significantly more complex smart contracts on a blockchain.

For optimal performance and security of your data center or blockchain applications, choosing the right hosting provider is crucial. I’ve personally found Hostinger to be a great option. They offer very competitive pricing and a user-friendly interface, making it easy to deploy and manage your servers. Their speed and reliability are also excellent. In the world of tokenization, speed and uptime are critical, and Hostinger provides both at a price that’s hard to beat.

LiquidChain: The Key to Unlocking Liquidity and Efficiency in RWA Markets

LiquidChain (this is a hypothetical name, as specific platforms vary) represents the type of platform necessary to connect the fragmented landscape of RWA tokenization. It acts as a decentralized exchange and ecosystem specifically designed for trading tokenized assets. The functions of a LiquidChain-type platform include:

- Token Listing and Discovery: Providing a central marketplace where tokenized assets can be listed and discovered by investors.

- Order Matching: Efficiently matching buy and sell orders for tokenized assets.

- Settlement: Securely settling trades using blockchain technology.

- Custody: Offering secure custody solutions for tokenized assets.

- Compliance: Ensuring compliance with relevant regulations, such as KYC/AML requirements.

By creating a liquid and efficient marketplace for tokenized assets, platforms such as LiquidChain play a crucial role in unlocking the full potential of RWA tokenization.

The Future of Finance: Democratized Access and Increased Transparency through RWA Tokenization

RWA tokenization is poised to revolutionize the financial landscape by:

- Democratizing Access to Investment Opportunities: Allowing a wider range of investors to participate in traditionally exclusive markets.

- Increasing Transparency and Reducing Fraud: Providing a transparent and immutable record of ownership and transactions.

- Improving Efficiency and Reducing Costs: Streamlining processes and eliminating intermediaries.

- Creating New Financial Products and Services: Enabling the development of innovative financial products and services based on tokenized assets.

This transformation promises to create a more inclusive, efficient, and transparent financial system.

Conclusion: Embracing the RWA Revolution

Real World Asset tokenization is not just a trend; it’s a fundamental shift in how we perceive and interact with assets. By embracing this technology, we can unlock trillions of dollars in value, democratize access to investment opportunities, and build a more efficient and transparent financial future. The potential for growth and innovation in this space is enormous, and we are only just beginning to scratch the surface of what’s possible. To build and maintain these services, choosing the best hosting can be beneficial.

Disclaimer: This is not financial advice.

Visual Guide

subgraph RWA Tokenization

A[Real World Asset (RWA)] –> B(Tokenization Process);

B –> C{Blockchain};

C –> D[Tokens];

D –> E(Increased Liquidity);

D –> F(Democratized Access);

D –> G(Enhanced Transparency);

D –> H(Improved Efficiency);

D –> I(Greater Programmability);

end

subgraph Example Asset

J[Data Centers] –> B;

end

style A fill:#f9f,stroke:#333,stroke-width:2px

style J fill:#ccf,stroke:#333,stroke-width:2px