# Grid Trading Bots vs. HODLing: A No-Leverage Strategy to Navigate the Post-Halving Crypto Market

The cryptocurrency market is known for its volatility, and this characteristic is often amplified following Bitcoin halvings. These events, which reduce the block reward miners receive, typically lead to increased price fluctuations as the market adjusts to the reduced supply. Navigating this post-halving environment requires strategies that balance potential gains with risk mitigation. This article explores two such strategies: **HODLing** and **Grid Trading Bots**, focusing on a *no-leverage* approach to ensure capital preservation.

## Introduction: Post-Halving Volatility and the Need for Safer Strategies (No Leverage Focus)

Bitcoin halvings historically usher in periods of increased volatility in the cryptocurrency market. While this presents opportunities for profit, it also elevates the risk of significant losses, especially for those using leverage. Therefore, many investors are seeking safer, less risky approaches. HODLing, a long-term holding strategy, and grid trading bots, when implemented without leverage, offer two distinct pathways to potentially benefit from post-halving market movements while minimizing downside risk. The key here is *no leverage*. Leverage magnifies both profits and losses, and in the volatile post-halving period, it can be a recipe for disaster for inexperienced traders. This article focuses on how these strategies can be applied responsibly.

## Understanding HODLing: The Time-Tested Strategy & Its Drawbacks in a Sideways Market

**HODLing**, derived from a misspelling of "holding," is a long-term investment strategy based on the belief that cryptocurrencies, particularly Bitcoin, will appreciate in value over time. It involves buying and holding crypto assets, regardless of short-term price fluctuations.

**Advantages of HODLing:**

* **Simplicity:** HODLing requires minimal active management. Buy and hold.

* **Reduced Stress:** Less focus on daily price movements can lead to lower stress levels.

* **Potential for Long-Term Gains:** Historically, Bitcoin has shown significant long-term growth.

**Disadvantages of HODLing:**

* **Opportunity Cost:** Capital is tied up, missing potential gains from other strategies.

* **Vulnerability to Bear Markets:** Prolonged downward trends can significantly erode portfolio value.

* **Ineffective in Sideways Markets:** HODLing generates no profits when prices fluctuate within a narrow range. This is particularly relevant in the post-halving period, where the market may experience extended periods of consolidation.

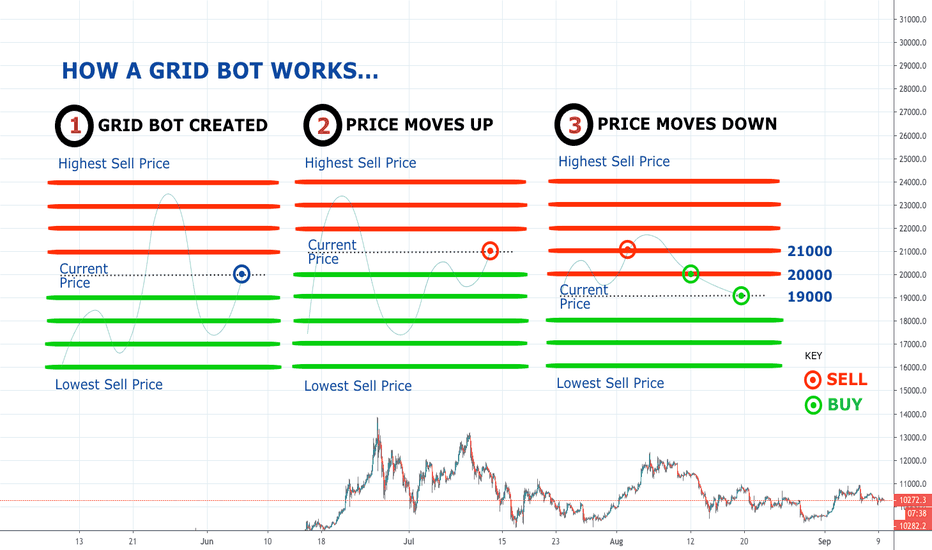

## Decoding Grid Trading Bots: How They Function Without Leverage & Capitalize on Volatility

**Grid trading bots** automate the buying and selling of assets within a predefined price range. The bot places buy and sell orders at predetermined intervals (the "grid"). When the price drops, buy orders are executed. When the price rises, sell orders are executed. The key difference in our context is the *absence of leverage*. Without leverage, the bot only uses the capital you provide, limiting potential losses to that capital.

**How Grid Trading Bots Work (No Leverage):**

1. **Price Range Definition:** The user sets an upper and lower price limit for the bot to operate within.

2. **Grid Creation:** The bot divides this range into several grid levels.

3. **Order Placement:** Buy orders are placed at each level below the current price, and sell orders are placed at each level above the current price.

4. **Automated Trading:** As the price fluctuates, the bot automatically executes buy and sell orders.

5. **Profit Generation:** The bot profits from the small price differences between buy and sell orders within the grid.

**Example:**

Let's say you believe Bitcoin will trade between $60,000 and $70,000 in the coming weeks. You set up a grid trading bot with 10 grid levels within this range. The bot places buy orders at $61,000, $62,000, etc., and sell orders at $69,000, $68,000, etc. As Bitcoin price moves within this range, the bot executes trades, profiting from each buy-low, sell-high cycle. Crucially, *no leverage* is used; the bot only uses the Bitcoin and USD (or stablecoin) you've allocated to it.

**Python Code Snippet (Simplified Example - illustrative purposes only):**

```python

def grid_trading(price, upper_limit, lower_limit, grid_levels, investment):

grid_spacing = (upper_limit - lower_limit) / grid_levels

buy_prices = [price - i * grid_spacing for i in range(1, grid_levels + 1)]

sell_prices = [price + i * grid_spacing for i in range(1, grid_levels + 1)]

print("Buy Orders:", buy_prices)

print("Sell Orders:", sell_prices)

#This is a simplified example. Actual implementation requires integration with a crypto exchange API.

#It also does not handle order execution or risk management.

#investment is your total investment amount.

Advantages of Grid Trading Bots (No Leverage):

- Profits in Sideways Markets: Unlike HODLing, grid trading can generate profits even when the price fluctuates within a range.

- Automated Trading: Reduces the need for constant monitoring and manual trading.

- Suitable for Volatile Markets: Can capitalize on price swings effectively.

- No Leverage, Reduced Risk: Significantly reduces the risk of capital loss compared to leveraged trading.

Disadvantages of Grid Trading Bots (No Leverage):

- Limited Profit Potential in Strong Upward Trends: Profits are capped by the grid range. If the price breaks out significantly above the upper limit, the bot will stop trading.

- Potential for Losses in Strong Downward Trends: If the price falls below the lower limit, the bot will hold the asset, potentially incurring losses if the price continues to decline. This is similar to the HODLing scenario.

- Requires Initial Setup and Monitoring: Requires careful parameter selection and periodic adjustments.

- May require a VPS: Running a trading bot 24/7 often necessitates a Virtual Private Server (VPS). For reliable and affordable hosting, I recommend Hostinger. They provide fast servers, excellent uptime, and are easy to use, making them ideal for hosting your grid trading bot.

Grid Trading vs. HODLing: A Direct Comparison of Performance, Risk, and Suitability Post-Halving

| Feature | HODLing | Grid Trading Bot (No Leverage) |

|---|---|---|

| Market Trend | Best in long-term uptrends | Best in sideways or volatile markets |

| Risk | High in bear markets, opportunity cost | Limited to investment capital (no leverage), range bound |

| Profitability | High potential in bull markets, zero in sideways | Consistent but lower profits within the grid range |

| Complexity | Simple | Requires setup, monitoring, and parameter adjustments |

| Automation | None | Fully automated |

| Post-Halving Suitability | Suitable if you expect a long-term bull run | Suitable if you expect sideways or volatile action |

In the post-halving environment, the optimal strategy depends on your market outlook. If you believe the halving will trigger a sustained bull run, HODLing may be the better choice. However, if you anticipate increased volatility and sideways price action, a no-leverage grid trading bot can offer a more consistent and potentially more profitable approach.

Implementing a No-Leverage Grid Trading Strategy: Practical Tips and Risk Management for Beginners

- Choose a Reputable Exchange: Select a cryptocurrency exchange that offers grid trading bot functionality and has a good reputation for security and reliability.

- Start with a Small Amount: Begin with a small amount of capital that you are comfortable losing. This allows you to learn the ropes without risking significant funds.

- Define a Realistic Price Range: Analyze the market and set a price range that is realistic based on historical data and your expectations. Don’t chase unrealistic profits.

- Choose Appropriate Grid Levels: The number of grid levels will affect the frequency of trades and the profit per trade. Experiment with different grid levels to find what works best for you.

- Avoid Leverage: This is crucial. Stick to a no-leverage strategy to minimize risk.

- Set Stop-Loss Orders (Optional): While the goal is no leverage, consider using a stop-loss order below the lower grid limit to protect your capital in case of a sharp downward trend.

- Monitor the Bot Regularly: Check the bot’s performance and adjust parameters as needed. Market conditions change, so your strategy should adapt accordingly.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different assets and strategies.

- Consider a VPS: For 24/7 bot operation, a VPS is highly recommended. Again, Hostinger is a great option because it is affordable, fast, and easy to use. They provide a stable environment for running your trading bot.

Conclusion: Choosing the Right Path – Grid Trading, HODLing, or a Hybrid Approach After the Halving

The choice between grid trading and HODLing depends on your individual risk tolerance, investment goals, and market outlook. HODLing offers simplicity and potential for long-term gains, but it can be ineffective in sideways markets. Grid trading bots, when used without leverage, provide a way to profit from volatility, but require more active management and a realistic understanding of market dynamics.

A hybrid approach is also possible. You could allocate a portion of your portfolio to HODLing and another portion to grid trading. This allows you to benefit from both long-term appreciation and short-term volatility. No matter which strategy you choose, always prioritize risk management and avoid using leverage in the volatile post-halving environment. Remember to do your own research and adapt your strategy to your specific needs and circumstances.

Disclaimer: This is not financial advice.

“`

Visual Guide

subgraph Post-Halving Crypto Market

A[Volatility] –> B(Strategies);

end

subgraph Strategies

B –> C{HODLing};

B –> D{Grid Trading Bots};

end

subgraph HODLing

C –> E[Long-Term Holding];

E –> F{Simplicity};

E –> G{Potential Drawbacks (Sideways Market)};

end

subgraph Grid Trading Bots

D –> H[Automated Trading];

H –> I{No Leverage};

I –> J{Buy/Sell within Price Range};

end

style A fill:#f9f,stroke:#333,stroke-width:2px

style B fill:#ccf,stroke:#333,stroke-width:2px

style C fill:#ccf,stroke:#333,stroke-width:2px

style D fill:#ccf,stroke:#333,stroke-width:2px

linkStyle 0,1 stroke-width:2px;

linkStyle 2,3 stroke-width:2px;